Introduction: The specter of protectionism haunts global trade

The year 2025 marks a turning point in international commerce as the Trump administration’s aggressive trade policies take center stage. A key element of this strategy is the imposition of substantial tariffs on goods imported from China, reaching a staggering 175%. Intended to rectify trade imbalances and stimulate domestic manufacturing, these measures have instead ignited a complex web of retaliatory actions, supply chain disruptions, and economic uncertainties. This blog delves into the multifaceted impacts of these tariffs, with a specific focus on ATMOSIScience, specializing in humidity control solutions, and how we are navigating this tumultuous landscape.

Tit-for-tat: China's retaliatory response

In a display of economic resilience, China swiftly responded to the U.S. tariffs by imposing reciprocal duties of up to 125% on American imports. These countermeasures strategically target sectors vital to the American economy, including agricultural products, energy exports, and machinery. Furthermore, Beijing has leveraged its dominance in the rare earth elements market by restricting their export, a move designed to cripple the U.S. tech manufacturing sector. This tit-for-tat escalation has created a precarious situation for businesses on both sides of the Pacific.

The tech and electronics sectors: Caught in the crossfire

The technology and electronics sectors, which rely heavily on intricate global supply chains, have been particularly vulnerable to the fallout from the trade war. As tariffs drive up the cost of essential components such as printed circuit boards (PCBs), connectors, and integrated circuits (ICs), companies are scrambling to diversify their sourcing and production locations. However, shifting operations to alternative countries like Vietnam and India is a costly and time-consuming undertaking.

Major players in the smartphone industry, including Apple and Samsung, heavily depend on Chinese factories for their manufacturing needs. The tariffs translate into higher consumer prices in an already inflationary market, impacting both businesses and consumers. The prospect of relocating production to the U.S., as championed by Trump’s policy, remains unfeasible due to a lack of cost advantages and an inadequately skilled workforce.

Automotive industry: Navigating uncharted waters

China’s exports of auto parts to the U.S., including engines and electrical components, now face substantial tariffs, leading to an estimated increase of $8,000 to $15,000 in the cost of producing each vehicle. Chinese manufacturers are actively exploring alternative markets in Europe and Southeast Asia, but the disruptions underscore the fragility of global supply chains.

Semiconductor industry: An ominous cloud looms

While the semiconductor sector has thus far avoided direct tariffs, the indirect consequences are already being felt. China’s retaliatory restrictions on rare earth exports are creating challenges for U.S. chipmakers, such as Intel and AMD. In response, Beijing is accelerating its domestic semiconductor production capabilities, aiming to reduce reliance on imports and potentially reshape the global tech landscape in the long term.

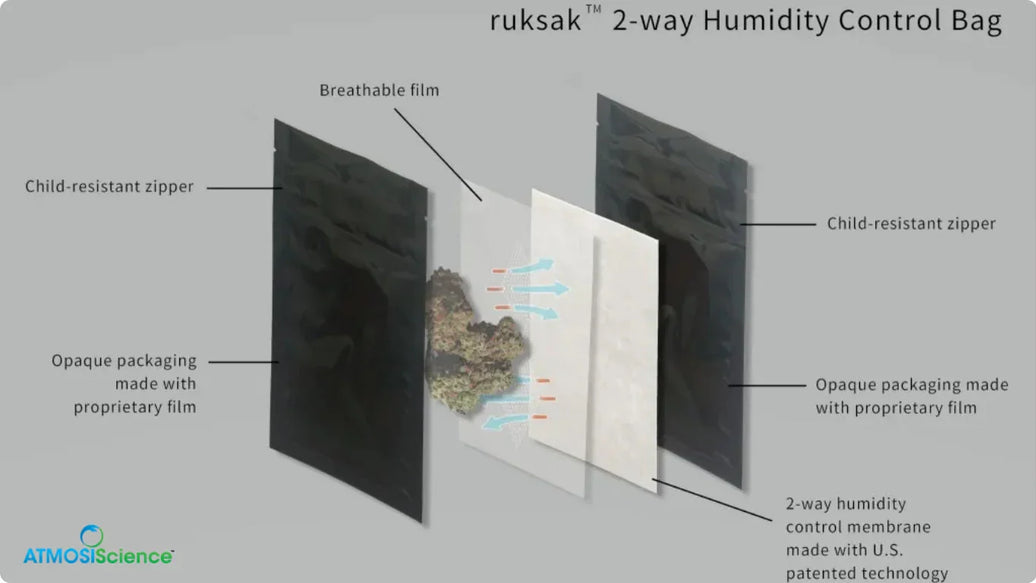

ATMOSIScience: A case study in the real-world impact of tariffs

ATMOSIScience, a company specializing in humidity control solutions, provides a compelling example of how tariffs can profoundly affect businesses. A recent announcement from the company highlighted that the cumulative effect of the trade war has led to a dramatic surge in import costs.

According to the statement, tariffs have imposed a cumulative effect that causes landed costs to more than double. With a factory located in Shanghai, ATMOSIScience now faces a total tariff of 175% on imports from China. As a result, the company anticipates price increases for the second and third quarters and has temporarily suspended custom orders while it assesses the situation.

To mitigate the impact, ATMOSIScience is prioritizing its partnerships in Canada, Africa, Vietnam, and South America. Furthermore, it is offering limited inventory of its humidity control bamboo bags, prioritizing existing customers.

The ATMOSIScience statement underscores the real-world consequences of trade wars, as businesses and consumers bear the brunt of political decisions. The sharp increase in import costs forces companies to make difficult decisions, such as raising prices, reducing production, or exploring alternative supply chains. The company also noted that once tariffs go beyond 100%, they kind of lose their meaning. For now, they’re pausing all custom orders while they monitor the situation and determine their next steps.

Economic resilience amid trade turmoil

China has implemented fiscal stimulus measures worth 1 trillion yuan ($138 billion) to support exporters and SMEs affected by tariffs. Furthermore, the government is actively promoting domestic consumption through subsidies for electric vehicles and smart appliances. These efforts aim to offset export losses and reduce the country’s dependence on foreign markets.

Looking ahead: Navigating a fragmented global economy

Trump’s tariffs have accelerated the trend of economic decoupling between the U.S. and China, contributing to inflationary pressures worldwide. While China faces significant challenges, the trade war also presents an opportunity to foster domestic innovation and forge new alliances within Asia and beyond.

As the global economy grapples with these changes, it is clear that globalization, as it was once known, is being redefined. Companies like ATMOSIScience find themselves caught in the crossfire, compelled to adapt, innovate, and seek new strategies for survival in this evolving economic landscape. The future of global trade remains uncertain, but businesses that can navigate these challenges with agility and resilience will be best positioned to succeed.